MoRTGAGE Loans

Mortgage loans fall into four pools of money, conventional, government, portfolio, & non-conventional. These loan programs are designed to help people & LLC's with the purchase and refinance of homes that they want. These loan programs are also utilized to help people rehab & build single family homes of all types.

Mortgage Loan Programs and Products

At Swift Lending, we specialize in making the dream of homeownership a reality for New Mexico residents. Whether you’re a first-time homebuyer, planning to refinance, or seeking to build a real estate portfolio, we’re here to guide you every step of the way.

Swift Lending offers a full menu of loan products whether you are buying your first home, building your dream home or investing in your 100th home, we have the loan for you.

Loan Products

Conventional Loans

Step into homeownership with confidence through a conventional loan. Known for their flexibility and competitive interest rates, these loans are a great fit for buyers looking for stability without strict government-backed requirements. With down payments starting as low as 3%, conventional loans cater to both first-time buyers and seasoned investors. Backed by Fannie Mae and Freddie Mac, they offer customizable terms to match your financial goals. Whether you're purchasing your first home or expanding your real estate portfolio, a conventional loan can help turn your dream into reality.

Government Loans

Make your path to homeownership easier with government-backed loans designed to meet a variety of needs. Whether you’re a first-time buyer, a veteran, or seeking a home in a rural area, these programs offer flexible terms and low down payment options:

FHA Loans: Perfect for first-time buyers, offering lenient credit requirements and affordable down payments.

VA Loans: Exclusively for veterans and active-duty military members, with no down payment and waived mortgage insurance.

USDA Loans: Tailored for rural homebuyers, providing low-cost financing and bringing you closer to the tranquility of countryside living.

Government loans open doors to your dream home with ease and affordability.

Non-Conventional Loans

Unlock the doors to your dream home with our bespoke loans, tailored for the unconventional home buyer. Whether you're self-employed, juggling intricate tax frameworks, or a property investor managing a robust rental empire, our loans resonate with your unique financial narrative. Dive into a sea of income calculation methods, including 1099s, Profit and Loss Statements, bank statements, windfalls, and rent receipts from your investments. Forge ahead without traditional lending shackles, even if your portfolio boasts 10 or more mortgaged properties. Embrace the power of financial inclusivity with us.

Portfolio Loans

Unlock financial potential with our bespoke Portfolio Loans, tailored and retained by the entity that understands your needs best—us. Our roots run deep through the community, with local banks weaving growth by investing depositor funds right back into the neighborhood—a vision of prosperity through infrastructure and development. As for private investors seeking to rejuvenate properties, from fixer-uppers to full rehabs, we're the trusted partners powering your real estate ambitions.

Loan Programs

Construction Loans

Construction loans are used to help people & LLC's rehab existing homes & build new homes. These loans typically involve the builder bringing cash to close and then the loans distribute your money through a draw process as different milestones of the construction process are completed.

Home Equity Loans

Home equity loans come in 2 loan products, refinances of a current home's mortgage with a cash distribution at closing that comes from the homes existing equity or a HELOC (home equity line of credit) this loan product leaves any current mortgage in place and allows for the distribution of cash from the home's equity. You can utilize both of these loan products on homes/properties that have been bought with cash or paid off. Also these loan products are available for the home you live in or own as an investment.

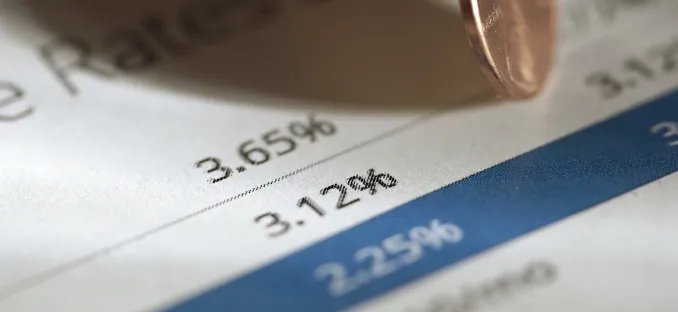

Conventional Fixed Rate Mortgages (FRM)

This is the most common & widely used loan product available, it is generally used by home buyers and home owners when they are looking for the safest & lowest rate mortgage loans.

Adjustable Rate Mortgages (ARM)

Adjustable rate mortgages or more commonly referred to as ARM loans are a great mortgage product for an experienced home buyer. This loan type generally has a fixed interest rate for a short period of time, generally speaking 3, 5, 7 or 10 years, then the rates will adjust with the market for the remainder of the loan term. The rates will adjust between a rate floor and ceiling, the floor is the start rate and the ceiling is typically double the loan amount. These loans are great for experienced homebuyers expecting to move in a short period of time.

Jumbo Loans

Jumbo loans are designed to help home buyers & owners who need to finance more than a conventional loan will cover, estimated to be $802,650 for the year 2025. Jumbo loans come in both fixed & adjustable rate programs and generally require 20% down but can be found with 10% & 15% down payment but will require significant discount points.

Refinance Mortgage Loans

Refinance loans come in two products rate term refinance and cash out refinances. Rate term refinance loans are mortgage loans that refinance a current loan on a home in order to lower the interest rate, move from an ARM loan or extend or shorten the term. Cash out mortgage loans are used for homeowners wanting to access their equity that their home has accumulated through years of ownership or appreciation. Cash out loans are also used by homeowners who have paid off their homes or bought their home with cash.

FHA Mortgage Loans

FHA loans are mortgages that are insured by the Federal Housing Administration (FHA), most commonly used by first time home buyers and home buyers with lower credit scores. FHA loan have more lenient underwriting standards, lower interest rates and higher mortgage insurance costs. These allow FHA loans to help a wider group of home buyers usually having lower credit scores & higher debt to income ratios.

Reverse Mortgage Loans

Reverse mortgage loans are distributed by FHA and utilize many of FHA's underwriting standards designed for home owners and home buyers who are over age 62. Reverse mortgages allow home owners to sell their home and then continue to live in them either collecting a monthly payment or a lump sum of cash at closing. For people age 62 and older the revers mortgage also allows them to buy a home with a down payment and then not have any monthly mortgage payments. These loans do have strict rules around residing in the home and are not intended to be passed down to your heirs.

VA Mortgage Loans

A VA mortgage loan is a home loan that's guaranteed by the Department of Veterans Affairs (VA) to help veterans, service members, and their families buy, build, improve, or refinance a home. VA loans allow for zero down payment, lower interest rates and waived mortgage insurances making it easier for veterans & active military to buy homes.

Self-Employed Borrowers

Self employed home buyers are welcomed to utilize all loan products inside all loan programs. Being self employed does come with a little more scrutiny from underwriters as their income is much more diverse than W2 employees. Most self employed borrowers will not face any issues once their income is calculated and confirmed.

Borrowers With Considerable Assets

Asset depletion is a newer loan product designed for homebuyers age 62 & younger. Typical income calculations involve taking 75% of a homebuyers liquid assets and dividing that number by 360 and then using that number as monthly income.

Real Estate Investors

Real estate investors are a group of home owners that own multiple homes and act as landlords to the people they rent the homes to. Conventional, portfolio, & non conventional loan programs all have loan products for real estate investors. These products make investing in real estate easier and do require larger down payments, some programs even allow for light & major rehabs to be done on the property.

Foreign Buyers

Unlock your dream of owning property in the United States with our tailored loan options for foreign buyers. Whether you're investing in a vacation home, a rental property, or a primary residence, we specialize in guiding international clients through the lending process. With flexible documentation requirements and expertise in navigating cross-border transactions, we ensure a smooth and efficient experience. Let us help you make the most of your global investment

Buyers With Blemished Credit Histories

Buyers with blemished credit will most likely need to get the blemishes reversed before being able to buy a home. Low credit scores typically fall into three categories. Number 1 is something bad happened a long time ago and the client gave up on credit altogether. Group number 2 is typically just sloppy credit multiple instances of minor credit issues and group three is you are currently missing payments. All three can be remedied rather quickly with group three being the most difficult because it involves cash.

Contact Info

Phone: 832-549-2859

Address: 105 Spruce St, Santa Fe, NM 87501

NMLS# 232825

Contact Info

Whether you're a first-time homebuyer, looking to refinance, or interested in building your real estate portfolio, Swift Lending is here to help. Let's work together to find the perfect mortgage solution for you.

© Copyright 2024. Serving clients in New Mexico and surrounding areas. Licensed mortgage broker.